DOGE Price Prediction: Navigating Critical Support and Market Sentiment

#DOGE

- DOGE is trading below its 20-day moving average, indicating short-term bearish pressure

- MACD shows positive but weakening momentum, suggesting potential trend change

- Current price action is testing critical Bollinger Band support at $0.203, which will determine near-term direction

DOGE Price Prediction

Technical Analysis: DOGE at Critical Juncture

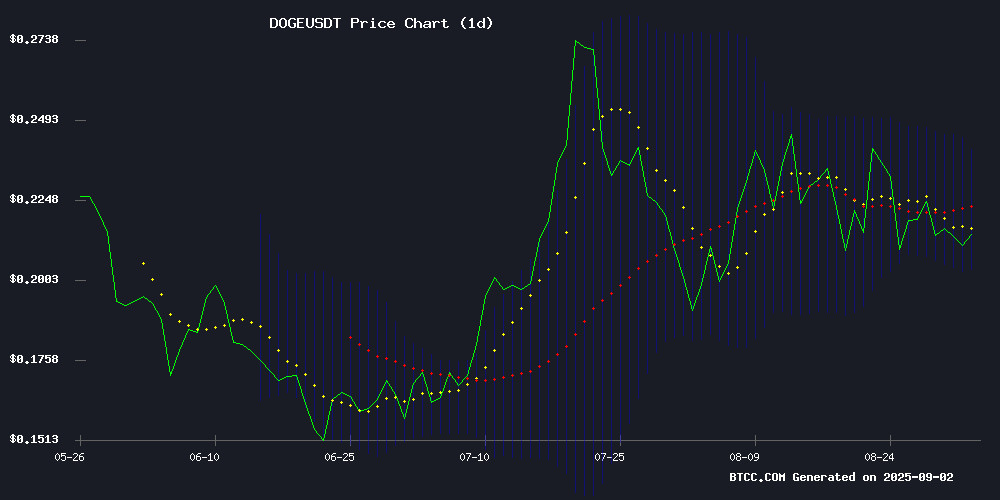

According to BTCC financial analyst John, Doge is currently trading at $0.21429, slightly below its 20-day moving average of $0.22177. The MACD indicator shows a positive reading of 0.004899, suggesting some bullish momentum remains, though the signal line at 0.003851 indicates potential weakening. The Bollinger Bands position DOGE between $0.20342 and $0.24013, with current price action testing the middle band. John notes that a break below $0.203 could signal further downside toward the lower band.

Market Sentiment: Caution Prevails

BTCC financial analyst John observes that current news FLOW reflects mixed sentiment for DOGE. Headlines highlight testing of key support levels and potential significant moves—either an 800% rally or a decline below $0.10. The Ichimoku indicator flashing a weak downtrend signal aligns with technical observations of cautious momentum. John emphasizes that while extreme outcomes are possible, the technical setup currently favors range-bound trading with downward bias until clearer signals emerge.

Factors Influencing DOGE's Price

Dogecoin Faces Downward Pressure as Key Support Level Tested

Dogecoin hovers precariously NEAR its 200-day exponential moving average at $0.211, a technical level that now serves as the battleground between bulls and bears. The meme cryptocurrency's failure to maintain this support could trigger further downside, with derivatives data painting a concerning picture for DOGE holders.

Market sentiment has turned decidedly bearish, as evidenced by negative funding rates across major exchanges. Short positions now dominate the derivatives landscape, with traders paying longs to maintain their bearish bets—a dynamic that historically precedes price declines. On-chain metrics from Santiment reveal accelerating distribution, as investors appear to be cutting exposure to the dog-themed asset.

The long-to-short ratio confirms this pessimistic positioning, with speculators increasingly wagering on continued weakness. This confluence of technical vulnerability and deteriorating market structure suggests Dogecoin may struggle to maintain current levels without a significant shift in sentiment.

Dogecoin Price at Crossroads: 800% Rally or Crash Below $0.1?

Dogecoin stands at a critical juncture, with technical analysis pointing to two divergent paths. A Fibonacci-based projection suggests an 800% surge to $1.82 could precede a brutal correction toward $0.09, according to analyst KrissPax.

Historical accumulation zones show strong holder support at current levels near $0.218, but the meme coin's volatility remains extreme. The proposed rally WOULD require breaking through multiple resistance levels unseen since DOGE's 2021 peak.

Dogecoin (DOGE) Enters Weak Downtrend as Key Ichimoku Signal Flashes

Dogecoin's price action shows mixed signals, with a bearish Tenkan-sen/Kijun-sen cross on the daily Ichimoku chart suggesting short-term weakness. The meme coin trades at $0.21, down 3% on the day, while remaining trapped in a symmetrical triangle pattern.

Technical analysts highlight $0.23 as a critical breakout level that could trigger short-term upside. The monthly rate of change indicator remains flat, indicating DOGE's next major bullish cycle hasn't yet begun. Support currently holds at $0.21517, with resistance at $0.22194.

Is DOGE a good investment?

Based on current technical and sentiment analysis, DOGE presents a high-risk investment opportunity. The cryptocurrency is testing crucial support levels while showing mixed technical signals. BTCC financial analyst John suggests that investors should consider the following factors:

| Factor | Current Status | Implication |

|---|---|---|

| Price vs. 20-day MA | $0.21429 (below MA) | Short-term bearish pressure |

| MACD Signal | Positive but weakening | Momentum may be fading |

| Bollinger Band Position | Near middle band | Neutral to slightly bearish |

| Support Level | $0.203 testing | Critical for near-term direction |

Given the current setup, DOGE may be suitable for traders with high risk tolerance, but conservative investors might wait for clearer directional signals.